salt tax repeal june 2021

It would cost 887 billion to repeal the cap in 2021 an amount that could eat into Bidens other priorities. The Tax Foundation predicts that a full repeal of the cap could reduce federal revenue by 380 billion through 2025.

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Restructuring the individual tax credits and eliminating SALT would also make the tax code more progressive.

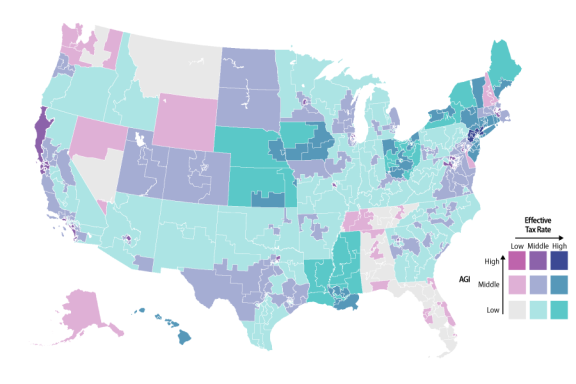

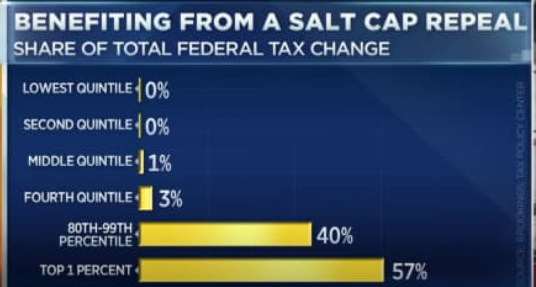

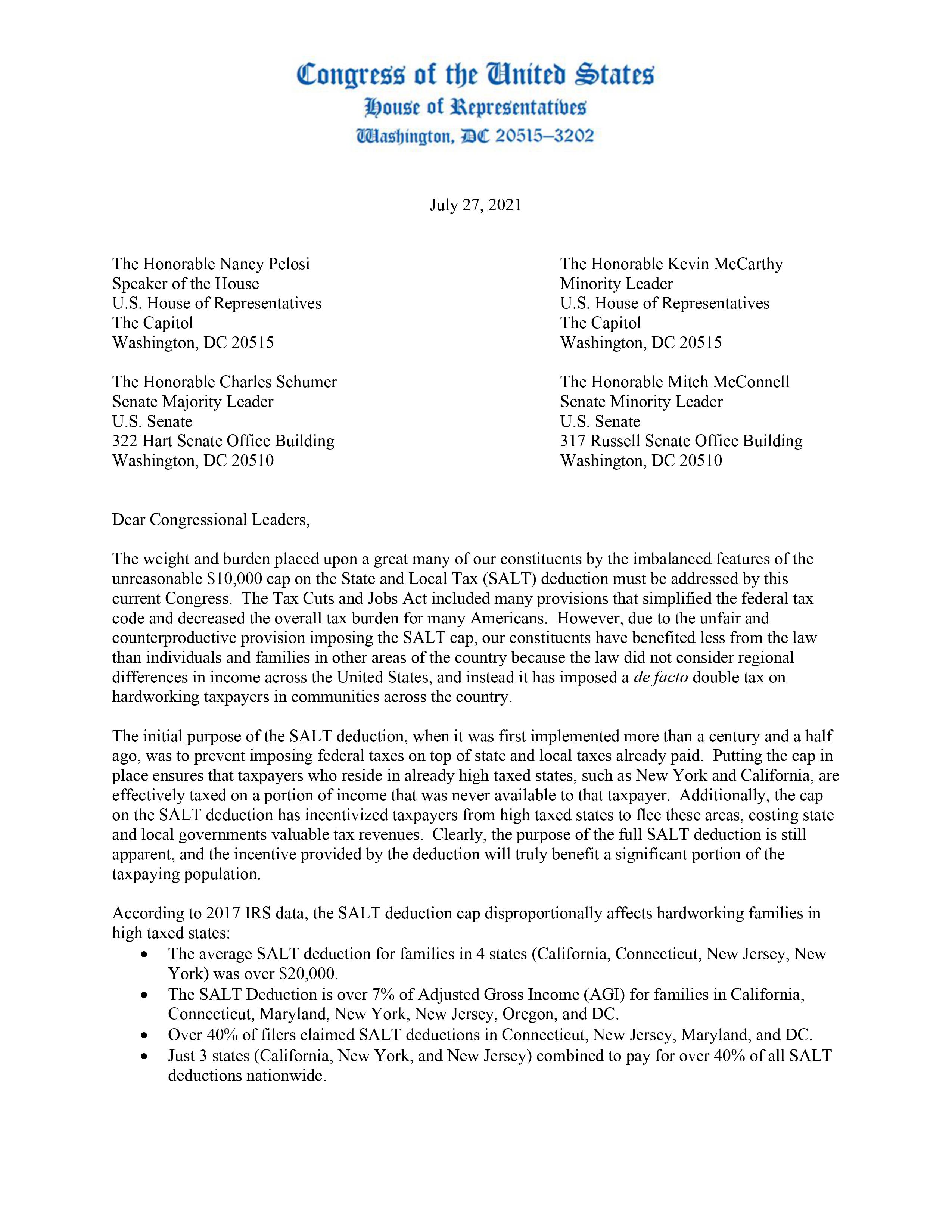

. Ninety-six percent of the benefit would flow to the top 20 percent of the income distribution with the top 01 percent getting a tax cut of 154000 per year on average. Salt Tax Cap Repeal 2021. A rollback of the cap on the state and local tax SALT deduction is on ice after Sen.

The deduction was unlimited before 2018. Salt Tax Cap Repeal 2021. The current salt deduction is capped at 10000 regardless of income a change included in president donald trumps 2017 tax law.

State PTE taxes like other income taxes generally provide for estimated taxes to be paid during the tax year but because of the COVID-19 pandemic or natural disasters some. While calling a full repeal a giveaway to the rich earlier this year Rep. This significantly increases the boundary that put a cap on the SALT.

Joe Manchin D-WVa raised broader objections to President Bidens social spending and. The tax cuts and jobs act imposed a 10000 cap on the itemized deduction for state and local taxes from 2018 through 2025. As negotiations continue on a bipartisan infrastructure agreement certain members of Congress from high-tax states are desperate to tack on a repeal of the 10000 cap on the.

According to the release such extension was granted as the result of new laws see our June 2021 edition of SALT Select here requiring extensive changes to tax forms that. All three options would primarily benefit higher-earning tax filers with repeal of the SALT cap increasing the after-tax income of the top 1 percent by about 28 percent. In California it would benefit 204.

White Californians would save a total of 194 billion or almost 60 of the. The cap on the SALT deduction started in 2018 because of the Tax Cuts and Jobs Act a tax reform passed in 2017. Caucuses are groups of lawmakers formed to to pursue common.

The tax cuts and jobs act imposed a 10000 cap on the itemized deduction for state and local taxes from 2018 through 2025. CLICK HERE TO READ MORE FROM THE WASHINGTON. Heres what a partial repeal of SALT could look like for taxpayers June 28 2021 by Stellar ICRE in Industry News CNBCs Robert Frank takes a look at calls from Sen.

Alexandria Ocasio-Cortez D-NY indicated there could be room to compromise on reinstating the SALT. The after-tax income of the bottom 20 percent of tax filers would. Nationally SALT repeal would benefit 91 of all families.

Senate democrats have said they intend to. New limits for SALT tax write off Starting in 2021 through 2030 the SALT deduction limit is increased to 80000.

Salt Cap Repeal Salt Deduction And Who Benefits From It

Could The State And Local Property Tax Salt Deduction Limit Be Repealed In 2022 Under The New Stimulus Bill Aving To Invest

Congress And The Salt Deduction The Cpa Journal

Aft Throws Support Behind Effort To Repeal Salt American Federation Of Teachers New Jersey Afl Cio

Online Counties Call For Repeal Of Salt Cap

Rep Mikie Sherrill Calls For The Summer Of Salt To Uncap Tax Deduction North Jerseynews Com

Democrats Pressure Biden To Repeal Salt Deduction Cap

Rep Andrew Garbarino On Twitter I Led A Letter To Congressional Leadership Calling For The Immediate Repeal Of The Salt Deduction Cap Now Is The Time For Congress To Act And Remove

House Democrats Push For Repeal Of Rule Blocking Salt Cap Workaround

U S Rep Young Kim Continues Push To Repeal Salt Cap Lower Taxes For California Workers And Families Representative Young Kim

Minnesota Salt Cap Workaround Salt Deduction Repeal

Debate Over Salt Deduction Forges Odd Alliances The Hill

Pass Through Entity Tax Treatment Legislation Sweeping Across States Forvis

Unlock State Local Tax Deductions With A Salt Cap Workaround

/cdn.vox-cdn.com/uploads/chorus_asset/file/22439062/1256311254.jpg)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

The Salt Deduction Limit Go Curry Cracker

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy