pay utah withholding tax online

The Utah State Tax Commissions free online filing and payment system. This section discusses information regarding paying your Utah income taxes.

Utah Withholding Tax 1 of 9 active Utah Withholding Tax.

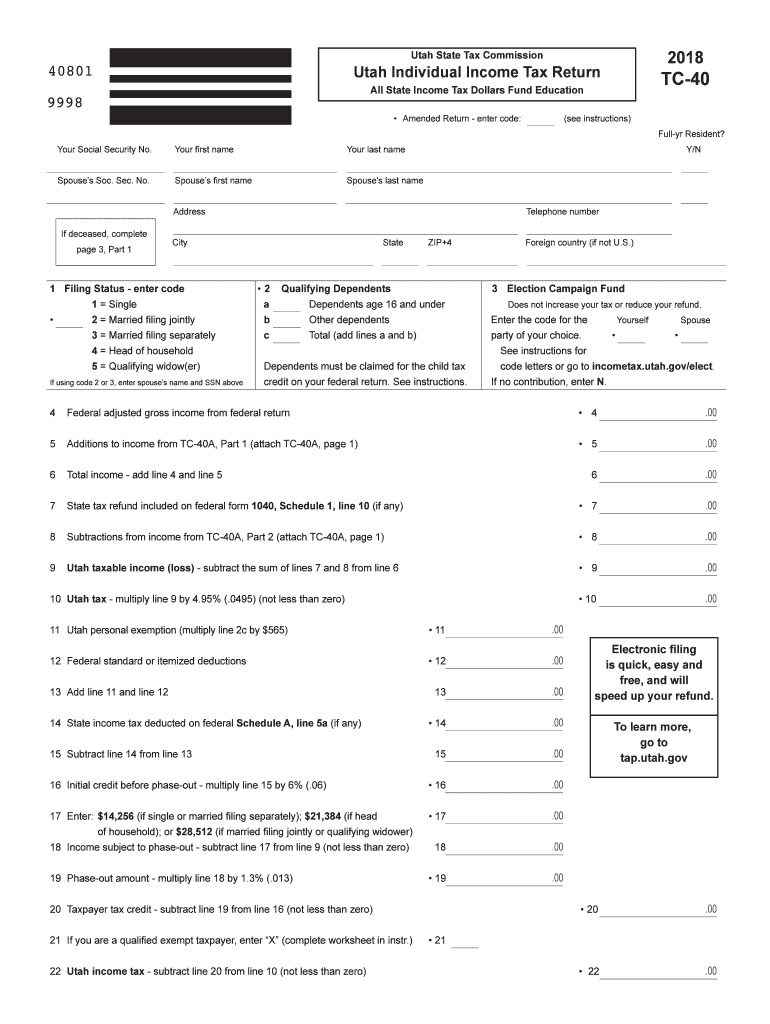

. All taxpayers in Utah pay a 495 state income tax rate regardless of filing status or income tier. This is a tutorial to show how to setup Utah State Withholding to calculate in AMS Payroll. Utah County City and Town Websites.

Without this information OnPay will be unable to file or deposit any Utah tax payments for your company. REFUND METHODS INFORMATION FORMS PUBLICATIONS OFFICES. Employers on an annual payment schedule file a single annual return You can.

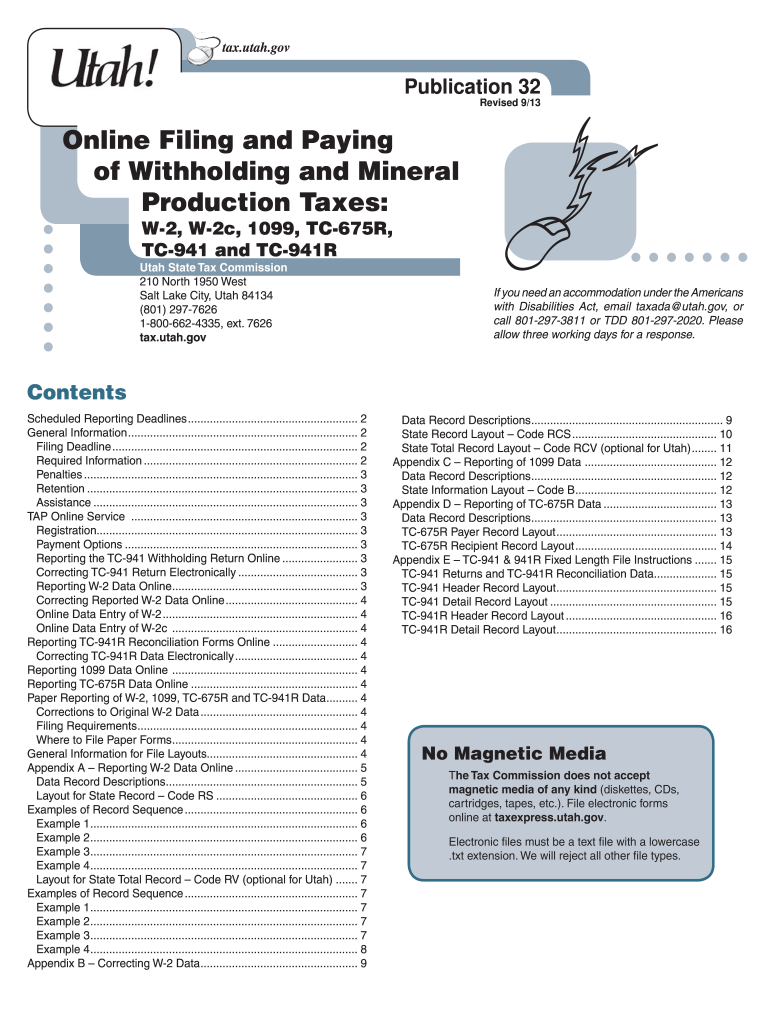

Pay by Mail You may also mail your check or money order payable to the Utah State Tax Commission with. To register for a withholding account go to Apply online area Click Apply for Tax account s TC-69 Instructions You are about to complete the Utah State Business and Tax. Filing online through the Vermont Department of Taxes new online system.

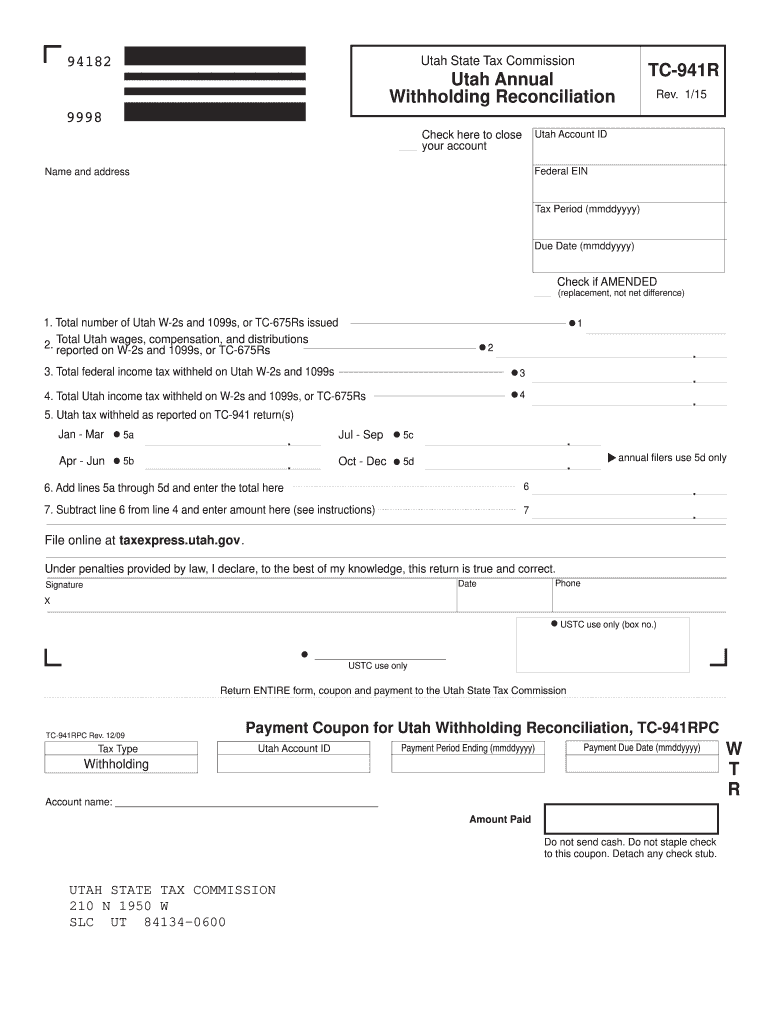

You will need to use Form 941 to file federal taxes quarterly and Form 940 to report your annual FUTA tax. After this process is complete you will receive a personal identification number PIN via US. Form TC-941PC Payment Coupon for Utah Withholding Tax is due monthly quarterly or annually based on the assigned payment schedule.

Online payments may include a service fee. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Please visit this page to contact your county officials.

SBAgovs Business Licenses and Permits Search Tool allows you to get a. Questions about your property tax bill and payments are handled by your local county officials. 1-Overview 3 of 9 1-Overview.

Follow the instructions at taputahgov. You may also pay with an electronic funds transfer by ACH credit. You have been successfully logged out.

Up to 25 cash back The returns reconcile the tax paid for the quarter with the tax withheld for the quarter. Please note that for security reasons Taxpayer Access Point is not available in most countries outside the United States. Follow the instructions on the payment screen to complete your EFT.

Employers may file the above. You will be assigned an Unemployment Tax Contribution Rate based on your industry. Tax Withholding Employees must designate the number of withholding allowances they wish to claim on their paycheck.

On the bottom left hand side of the page find the Payments box and select Make a payment without signing in. You can also pay online and avoid the hassles of mailing in a. Utah Code and Constitution.

Any penalties and interest that accrue from missed tax payments. 2-General Information 4 of 9 2-General Information. You can pay taxes online using the EFTPS payment system.

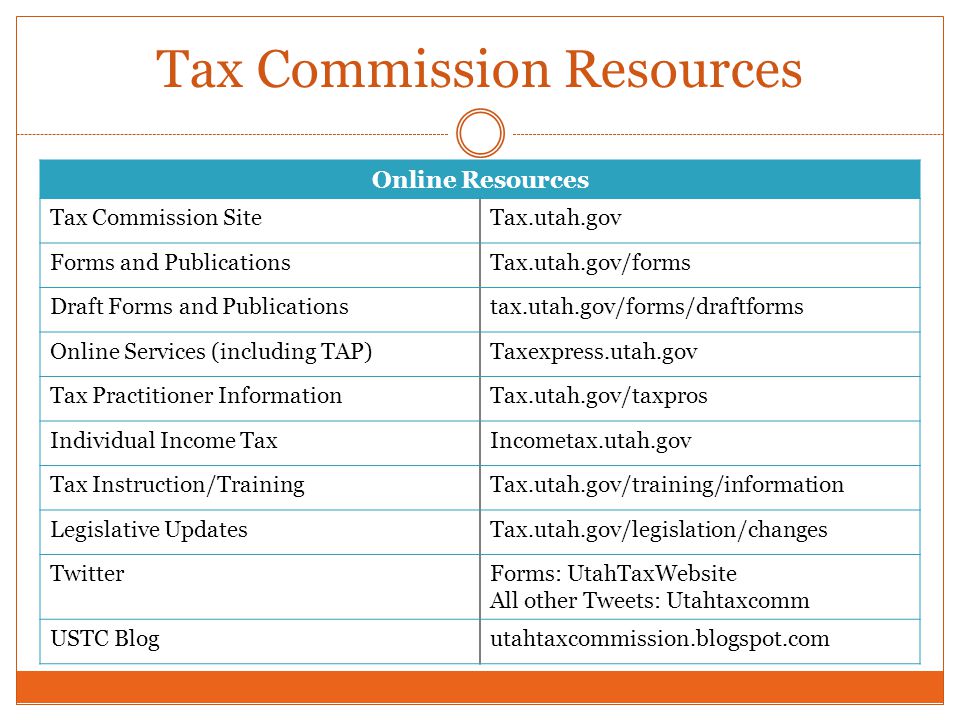

INSTRUCTIONS LINE-BY-LINE INFO FILING PAYING YOUR TAXES TOPICS CREDITS ADDITIONS ETC. Please contact us at 801-297-2200 or taxmasterutahgov for more information. Find Your Utah Tax ID Numbers and Rates.

Payments using this Web. Mail in five to seven business days at your IRS address of record. You may now close this window.

For more information contact the agency at 801 526-9235. To update increase or change the number of exemptions you have. File electronically using Taxpayer Access Point at.

Overview of Utah Taxes. This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file. Utah has a very simple income tax system with just a single flat rate.

TAP Taxpayer Access Point at taputahgov. All taxpayers may file returns and pay tax due for Withholding Tax using myVTax our free secure online filing site. Main Menu 2 of 9 Main Menu.

Provides free tax help. 3-Filing 5 of 9.

9 States With No Income Tax Are They Worth It Parade Entertainment Recipes Health Life Holidays

Complete A 2015 Utah State Tax Return Fill Out Sign Online Dochub

How To Pay Utah Tax Online Youtube

Utah State Withholding Tax Setup Youtube

Sales Taxes In The United States Wikipedia

W2 Form Utah Fill Online Printable Fillable Blank Pdffiller

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

Expect Long Delays In Getting Refunds If You File A Paper Tax Return Tax Policy Center

Sales Taxes In The United States Wikipedia

Ebay Or Etsy Sale Of 600 Now Prompt An Irs Form 1099 K Money

File Your Own File Taxes For Free Earn It Keep It Save It Utah

Tc 941 Utah Withholding Return Utah State Tax Commission

Utah State Tax Commission Ppt Download

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Tc 941 Utah Withholding Return Utah State Tax Commission

Utah State Form 941r On Line 2015 Fill Out Sign Online Dochub

Do I Have To File State Taxes H R Block

Pay Your Taxes Online Dow Cpa Utah Tax And Accounting Services